🔥 5 Top Sites From Flippa, Plus Your Investing Updates

This Thursday's top stories for online entrepreneurs turned investors, with updates on the markets, online business, real estate, startups, and crypto.

MARKETS UPDATE

JP Morgan CEO Jamie Dimon thinks that rates will go above 5%, due to a lot of "underlying inflation" that will take considerable time to resolve.

US hits debt ceiling, prompting Treasury to take extraordinary measures, such as suspending new investments in various government accounts.

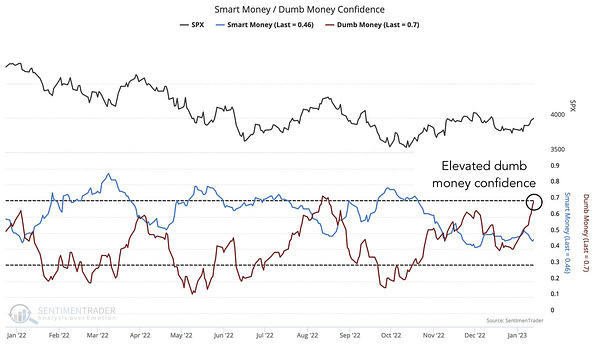

But that isn’t affecting dumb money, with Wall Street’s fear gauge at its lowest level in months…

Chart of the day

ONLINE BUSINESS UPDATE

ThriveCart, the seven-year-old Austin startup and a tool used by many of us for selling digital products and affiliate management, raised a $35M round led by LTV SaaS Growth Fund.

Onfolio announces its acquisition of Content Ellect. This is its 4th acquisition to date.

And Discourse by Onfolio had a great piece on how your funding will run out fast if you can’t do the math.

Sponsored Ad

🔥 Flippa’s Top Assets for Sale 🔥

Buckle up: these businesses are hot on the marketplace.

1. Five-year-old Song Interpretation Website — $1,150,000

Monthly Profit: $18.6K

Domain Authority: 52

Monthly Page Views: 1.7M

Profit Multiple: 5.1x

2. Nine-year-old LinkedIn Marketing SaaS — $300,062

Monthly Profit: $6.4K

MRR: 4.2K

LTV: $1K

Profit Multiple: 3.9x

3. Seven-year-old Road Construction Website — $577,360

Monthly Profit: $22.8K

Authority Score: 48

Subscribers: 100K

Profit Multiple: 2.1x

4. 12-year-old VPN Provider SaaS — $125,000

Monthly Profit: $5.3K

Profit Margin: 71%

Subscribers: 152.2K

Profit Multiple: 1.9x

5. Four-year-old Products Review Website — $85,000

Monthly Profit: $3.2K

Monthly Page Views: 49.7K

Traffic: 98% organic

Profit Multiple: 2.2x

Want more?

STARTUPS UPDATE

Microsoft will lay off 10K employees, close to ~5% of its workforce, amid economic uncertainty and to refocus on priorities such as AI.

Amazon kicked off its round of job cuts affecting 18K people.

Twitter's daily revenue has dropped 40% YoY, with more than 500 advertisers having left or paused spending.

CRYPTO UPDATE

CoinDesk, the crypto media company, is exploring acquisition options including a partial or full sale, owing to "numerous inbound indications of interest”, having received multiple unsolicited offers of $200M+.

Alameda Research liquidators have reportedly lost ~$11.5m in trades.

SBF, in his own Substack, claimed FTX US is solvent and able to repay customer funds, accusing lawyers of being 'misleading'.

REAL ESTATE UPDATE

Property funds such as JPMorgan and Morgan Stanley have received withdrawal requests for $20B from their investors.

Sotheby’s says Canada is entering a buyer's market for luxury real estate, as luxury home sales dropped in major Canadian cities.

Lower, has announced the launch of its Mortgage as a Service platform, and onboards OpenDoor as its first customer.

Interested in sponsoring our newsletter?

You'll find all the details here.

That’s it for this week. If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.doc