🐓 An Investing Cockpunch...

... For those who bought the top of Tim Ferriss new NFT project. Plus updates on the markets, online business, real estate, startups, and crypto/NFTs.

Hi there 👋,

It’s been a rough week in the markets, but as long as you didn’t buy a Cockpunch NFT for 1.8ETH, you’re doing well.

MARKETS UPDATE

The SEC will issue four proposals next week to help retail investors get better prices on trades. The proposed "order competition rule" would require some trades made by retail investors "to be exposed to competition in fair and open auctions before they could be executed internally by any trading center that restricts order-by-order competition."

Wall Street indexes are struggling due to concerns on recession worries and that the Federal Reserve's monetary policy would tighten.

The United Kingdom will raise its corporate tax rate from 19% to 25% in April 2023, for companies that make more than $250K in annual profit.

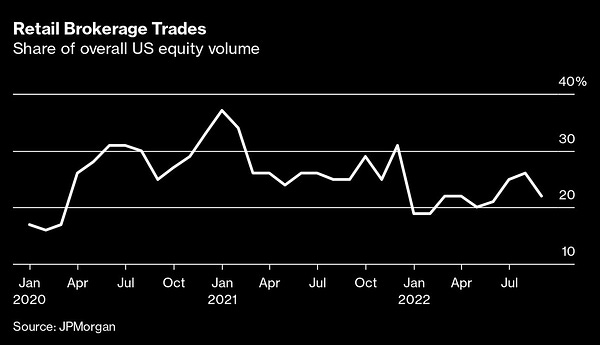

Chart of the day

ONLINE BUSINESS UPDATE

EF Capital Round 4 deals have now raised over $3M in total and the round looks to be closing soon. Those who invested in Round 1 deals are generating an average of 15% annual cash returns over the last twelve months. Learn more.

Domain Magnate’s Round2 for GroupBuy1 is closing on Dec 16th. The first groupbuy was started a year ago and they’ve acquired 2 websites, and are currently finalizing an additional small raise to buy a third website. $54K minimum investment.

ChatGPT could be a serious threat to Google, offering clear answers to difficult questions that require no further searches. Travis goes into this in more detail in his newsletter Diving into the crazy new ChatGPT.

Richard Patey published Top 20 Upside Wins for Website Acquisitions:

REAL ESTATE UPDATE

The US Housing Market Index declined to its lowest level in a decade, indicating that it is already in recession. It’s currently at 33 on the index which is rated on a 100-point scale, and anything below 50 is considered in trouble.

Economists are searching for signs of a turnaround in China’s real estate market. Since July 2021, housing projects have declined by double digits.

Stellar, the marketplace for single family rentals, raised a $20M Series B round led by Weatherford Capital. Its marketplace enables property managers and contractors to address home maintenance issues.

Giraffe360, the London-based real estate tech startup, has raised $16M in its Series A funding round led by Founders Fund.

Sponsored Ad

🔓 Unlock luxury rental ROI 🔓

Have you seen or stayed in luxury homes on AirBnB or VRBO and thought about what a great asset class they would be if not for the headaches of ownership?

Voyax Capital provides investors like you access to luxury vacation rental real estate, without the hassle and concentrated risk of DIY or fractional ownership.

Voyax combines machine learning with an institutional fund and 5-star management expertise for:

High-Cash-Flow Passive Income

Capital Appreciation

Zero-Hassle Diversification

Inflation Protection

Tax Benefits

Voyax partners with the luxury experts at Boutiq to buy design-focused properties in the right locations, then build out first class amenities appealing to affluent vacationers seeking unique experiences.

With 7+ years experience as AirBnB Plus "Superhosts" (VRBO "Premier Hosts" etc.) and 20 active properties currently under management, Voyax + Boutiq can deliver.

STARTUPS UPDATE

European startups raised $85B this year, according to VC firm Atomico's annual State of European Tech report. This is a drop of $15B compared to 2021, but that may have been an outlier year following COVID-19 lockdowns. The war in Ukraine, economic uncertainty, and an "unfriendly regulatory environment" are cited reasons for the drop in funds. European IPOs are also down by 30% compared to 2021, and unicorn valuations are down.

Plaid cut its workforce by 20% (260 employees). CEO Zach Perret said the company's revenue growth "did not materialize as quickly as expected" due to the "economic slowdown" and that cost growth outpaced its revenue growth. Plaid raised $425M at a $13.4B valuation in April 2021.

Kapu, the social commerce startup, raised $8M at an undisclosed valuation. Kapu lets consumers order groceries in bulk, via its B2C e-commerce platform, and receive discounts of up to 30%.

🦄 SEOs with Skin in the Game

Smash Digital - a growth agency, filled to the brim with unicorn images and SEO memes. A team of SEOs with actual skin in the game, ranking their own portfolio of profitable businesses, and offering the exact same services to clients.

An agency with so much link juice you’ll need a mop and bucket to clean it all up.

CRYPTO UPDATE

The New York Times reported that Federal prosecutors are investigating Sam Bankman-Fried over possible market manipulation of Terra/Luna, whether he influenced prices of the digital assets to benefit FTX and Alameda Research.

Ledger has launched a new palm-sized wallet called Ledger Stax. It comes with an e-ink touch screen and wireless charging, plus you can stack multiple devices through embedded magnets.

Goldman Sachs is reportedly looking to acquire or invest in crypto firms while the valuations are low. Big banks are seeing opportunities in the space as the FTX collapse highlighted a need for more regulation.

Twitter may be moving towards integrating crypto payments and even a native coin (if it’s not going to be DOGE). A security researcher extracted code for a vector image depicting a Twitter Coin and previously Musk has said “it is kind of a no-brainer for Twitter to have payments, both fiat and crypto.”

NFT UPDATE

Tim Ferriss launched his NFT collection Cockpunch yesterday. 5,555 minted out within an hour, the floor ripped to over 1.8ETH and it was all looking like another Moonbirds, before pulling back to < 1 ETH floor price. The reveal is tomorrow, where typically the price drops further.

Porsche debuted its new NFT collection based on its 911 model. There will be a supply of 7,500 NFTs available in January 2023.

ApeCoin holders staked $32M with rewards starting on 12th December, but as you can see in the markets update, APE is still down over the last month.

Interested in sponsoring our newsletter?

Thanks for your interest in sponsoring the investing.io newsletter. The newsletter goes out every Thursday.

You'll find the details here.

If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.