In this episode of the Website Investing podcast I speak with Greg Elfrink, the Director of Marketing at Empire Flippers, on content site trends in 2020.

In this part 1, free subscribers get the first 30 minutes of the conversation; paying subscribers also get part 2 in their RSS feed. As is typical, part 2 elicits more insights as we get deeper into the conversation.

This is the first episode with Avi Silverberg as the Producer of the show. Avi has been a paying subscriber since January (the first month I launched the newsletter) and is a successful site builder and publisher (who had his own podcast) so we’re very lucky to have him.

EPISODE SPONSORS

🔥 Niche Website Builders - a hands-off approach to outsourcing your content. Packages include keyword research & high-converting review templates. Get 10% off your first order.

🔥 Ezoic - an AI-driven platform built for publishers to optimize ad revenue and maximize site speed. You can start a free trial of Ezoic today.

Part 1 Show Notes

A Snapshot of The First Half of 2020

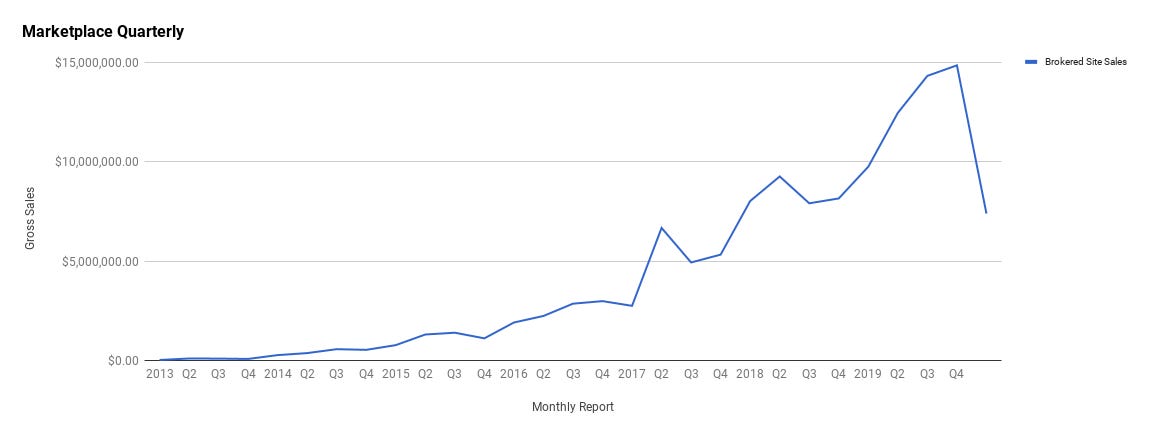

Empire Flippers Q1 2020 Quarterly Report—January, February, March

Ecommerce businesses were disrupted more during Covid

Most products for e-commerce businesses were sourced through China, which was at the epicenter of the virus. As a result, they couldn’t get their hands on products causing a lot of businesses to run out of inventory.

Also, Amazon wasn’t accepting non-essential products into their warehouses (in America).

Affiliate business got hit with Amazon rate cuts

For affiliate businesses, April brought the Amazon rate cuts. Some cuts were 50%.

However, some affiliate niches saw traffic increases, so even though rates were cut, their revenues didn’t drop because they were doing more volume.

Seller submissions were still high, but buyers had cold feet

There were still a lot of seller submissions in Q1, which is always the case. However, buyers got cold feed because they don’t want to deploy capital in an uncertain market. Buyers had an attitude of “let’s wait and see what happens with Covid”.

Q2 came roaring back

May was Empire Flippers’ biggest month in terms of deal volume (dollar amount sold).

Buyers’ confidence started to come back.

If there weren’t buyers in the market then multiples might go down, but they aren’t seeing that. At least for now, capital is still being deployed. But this could change, we’ll have to wait and see.

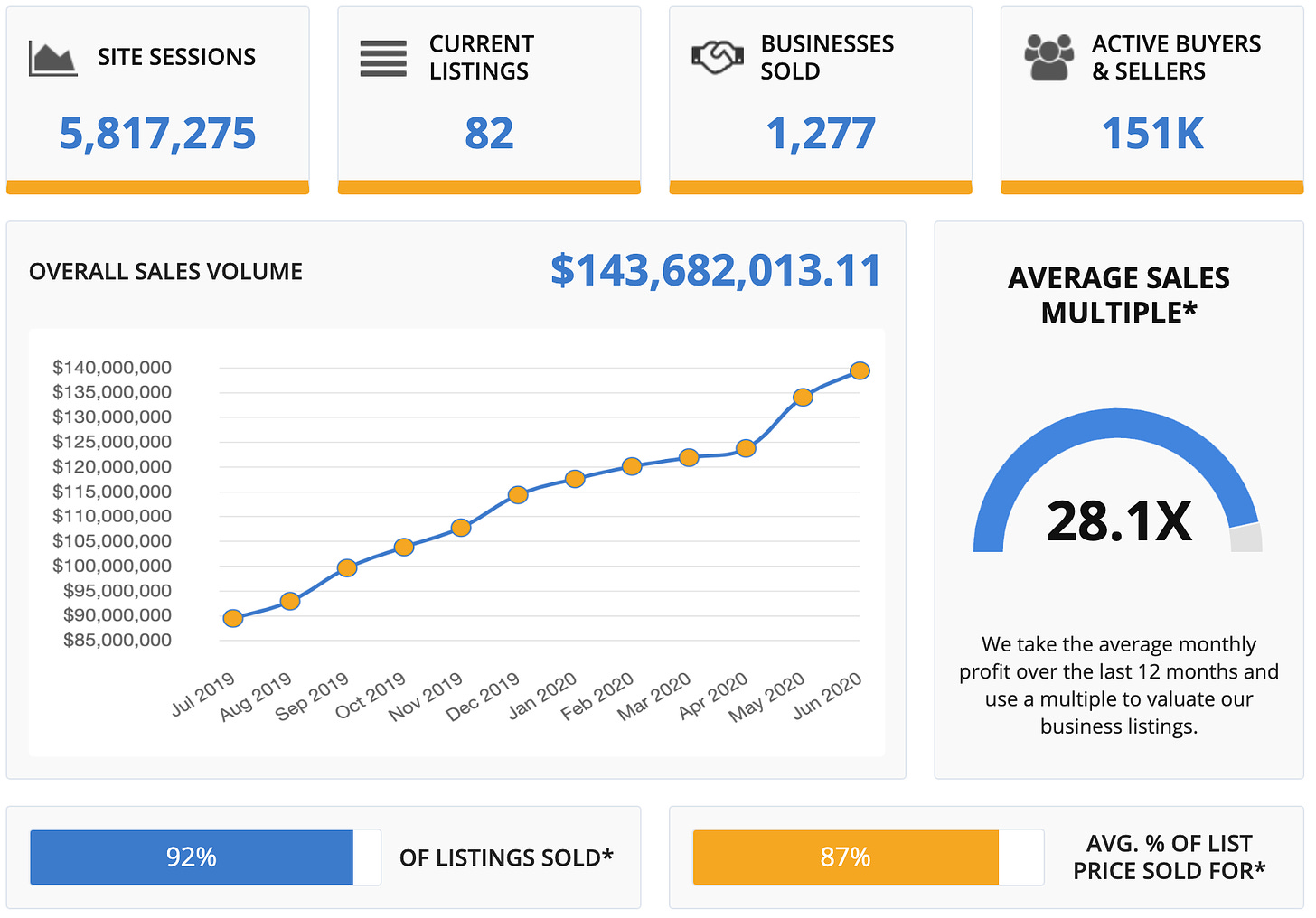

Deal size is going up Overall

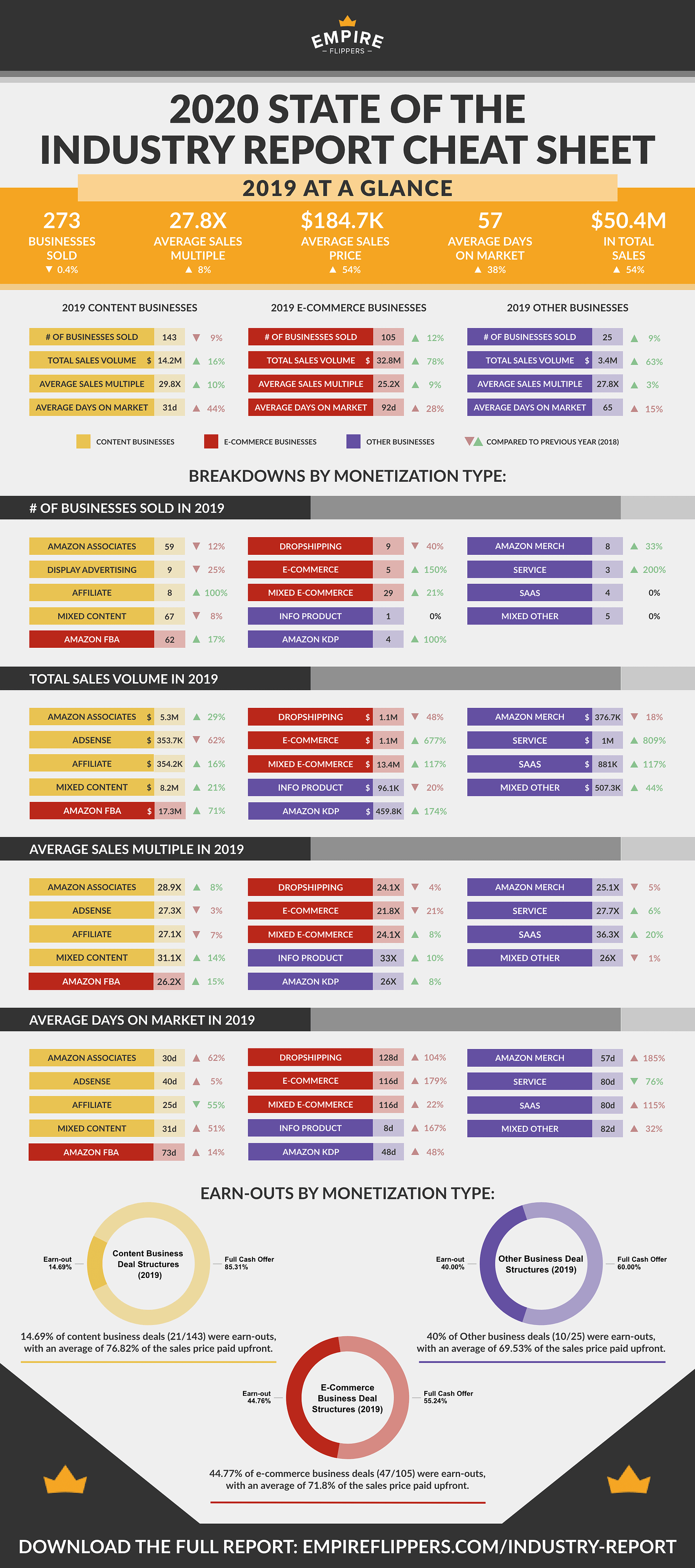

2019 had 9% fewer content businesses listed on the Empire Flippers marketplace but deal size went up by 16%. So they’re selling bigger content businesses. This is why multiples also went up for content businesses because as deal size goes up typically the multiple goes up.

Demand has not gone away for content businesses. It’s still rising. There is also a lot of new investors coming into the space who are looking for content businesses. Another reason why multiples are going up is because they’re all fighting over the same deals.

Online Business Trends for Buying and Selling Websites in 2020

New Criteria For Listing On Empire Flippers

They’ve become very strict with listing dropshipping businesses, especially through Alibaba. A lot aren’t making it onto their marketplace.

There is still a misconception that Empire Flippers only sells affiliate businesses worth at least $50,000.

This is not true though.

They have a minimum that sites need to make ($500/month in net profit over the last 12 months). But these small sites usually get picked up really quickly, so you might not see the smaller sites on their marketplace even though they do exist.

New Competition For Empire Flippers

There are other places to sell online businesses now.

But Greg’s seeing an increase in people doing private deals. This is mostly because people are more educated now on how to sell an online business.

Predictions For Future Because of Covid?

Prices could start dropping uniformly across the marketplace if Covid creates uncertainty. But Greg doesn’t think that will happen. There is a lot of confidence built up in the digital asset space right now.

Websites Are Assets

People are recognizing that content sites are assets now.

Content sites are not the riskiest and have a lot of opportunities.

This is because you can expand a content site into any other business model out there. You can leverage it for an FBA business or add a membership. Greg has even seen sites create a software-as-a-service built on the back of their content business.

Depending on your creativity and knowledge of the content model, you can scale it.

The Business Model of Content Sites

A lot of people fail to understand the content business model.

People think it’s: rank on Google, drive traffic to a round-up post, and click an affiliate link. As Greg states:

The business model is not to click the affilaite link; the business model is to nurture and retain the audience.

Episode 9 Part 2

In part 2 of this conversation we discuss:

How financing works within the industry, including at what price point sellers should expect to receive an earn-out.

The increase of private equity coming into the website investing space, and how these firms value businesses.

Why Greg is bullish on content sites, and how he’s actively trying to educate this ‘traditional money’ on the opportunity of content sites.

Two other interesting trends of website investing, including search funds and family offices.

Part 2 is for paying subscribers, you can access by hitting the button below.

Enjoyed this episode or have any questions? You can leave a comment at the bottom of the web version of this post.

E9 Part 1: Greg Elfrink from Empire Flippers on 2020 Trends