How to Snowball $100k into $1MM within 3 Years

First published at https://richardpatey.com/website-investing/The greatest upside I see right now from any asset class is the buying and selling of profitable websites - online assets similar to real estate that yield cashflow.

In this post I set out how you can snowball your way from $100k to $1MM within 3 years by flipping websites.

I want to preface this post by saying that I don't personally acquire revenue generating sites to flip like this; rather I adopt a micro acquisition approach where I buy low cost (sub $5k) aged sites with traffic and rankings and build out on those to flip.

Investing in Websites - the 40% Rule

The Tropical MBA podcast a few weeks ago on the "40% Rule" by Jase Rodley discussed how you can generate 10x higher returns through website investing than you can from having your capital in index funds where you draw down 4% a year.

If you buy a website at a monthly profit multiple of 30x then it will return your investment in 2.5 years which is the same as yielding 40% a year.

Therefore if you have the skillset to operate and maintain a website (just maintain, rather than grow) then you can effectively retire with 1/10th the amount of capital.

$1MM will generate $40k a year from index funds (and possible not much more from real estate) or $400k a year from investing in websites.

So how do we get to this $1MM capital goal starting with just $100k?

We snowball our way there by buying and selling (flipping) websites.

The Snowball

Sam & Johnny on an episode of Invest Like a Boss discussed at the end The Snowball biography of Warren Buffet of compounding money over time and that at an 8% interest rate it takes a long time to build wealth. Sam states:

I feel like for the average person you can get that [snowball] effect in property like no other asset class because you are going to get the yield and capital appreciation as that property increases over time.

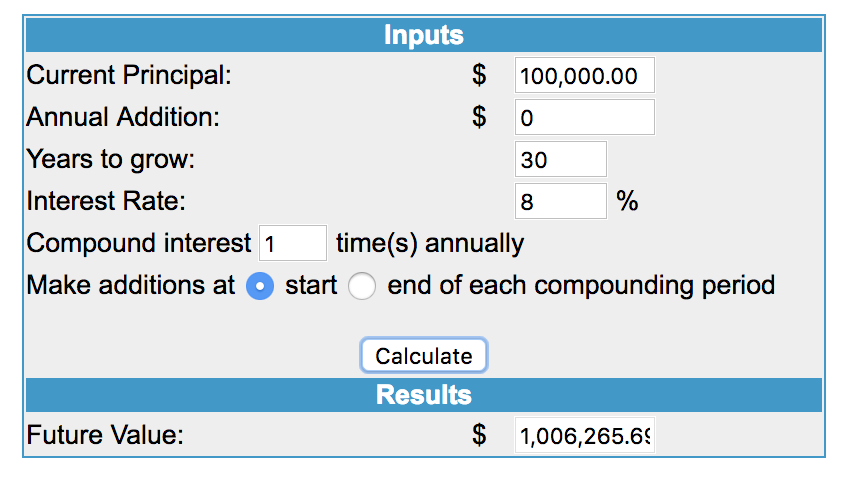

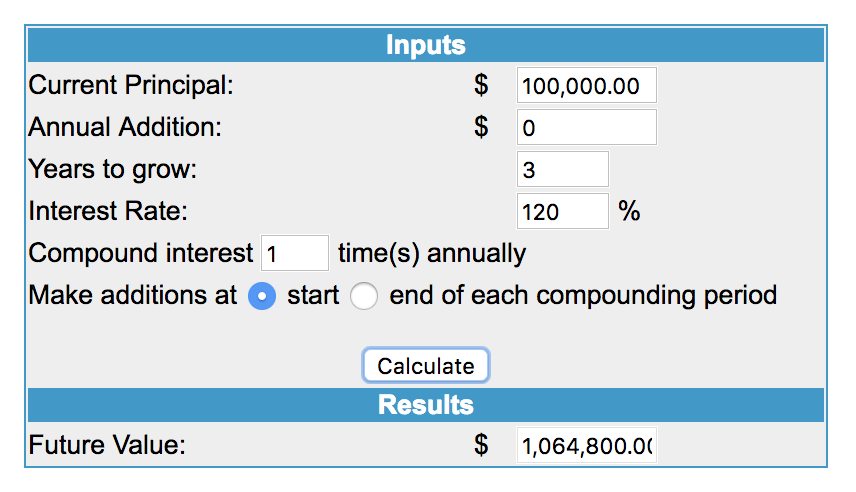

Indeed at 8% it will take 30 years to turn your money from $100k into $1MM.

In the website flipping approach I outline below, you can compound the combined cashflow and asset price to go from $100,000 to $1,000,000 in 3 years which works out at 120%:

But on top of this, people are depreciating websites over 3 years (or one year if more aggressive) and are using the tax money saved from website income to purchase more websites at the same time, shortening the timeframe further. Here is a great video by Ace Chapman explaining the tax benefits from buying websites.

The Website Flipping Model

This strategy assumes you already have $100k for website investing or have built a website from scratch to a value of $100k. It assume you possess a an expert operator skill set that you can deploy at no cost that will on averageover the long run double a site's income and asset value, in the way that a profitable poker player has a real positive expected value win rate when you take out short term variance.

You can double a website's value in many ways:

Doubling conversion rate on an under-optimized site if you are a CRO master

Improving domain authority by being able to redirect powerful links

Optimising ad monetization or swapping from one ad network to another

Content pruning: reducing keyword cannibalization or improving crawlability by reducing index bloat

Doubling opt-in rates if you are a sales funnel expert

Doubling average order value on digital products by adding upsell funnels

You can also double a website's value by simply investing in new top quality content, but the results from that take longer to materialise and that's an additional expense that you need to budget for so I've not factored that into this model of buying existing revenue generating sites. However it's an approach I personally like to deploy when picking up non revenue generating micro-acquisitions based on traffic value.

Assumptions

For simplicity I am going to be assuming the following:

Sites list at a 30x monthly multiple (to achieve the 40% rule) which is real as a survey from Empire Flippers found that the average sales multiple for a six-figure content site comes out to 28.89x.

To make the maths easier, it costs nothing to buy a website and costs 15% to sell one (brokerage fees and all fees). I'm also assuming that the price you get after broker fees would be the same as if you were to sell privately, i.e. the broker representing you gets you a higher price but after their fees you bank the same amount as you would have got selling privately / off-market.

It only takes one month to sell (the average time it takes content sites to sell on Empire Flippers is just 27.52 days) and two months to buy, after doing website due diligence.

After you buy invest in websites, you also invest three months of your own time leveraging your skill set (rather than reinvesting the site's income into purchasing new content / links) and then list after six months of upside. Add in the 1 month to sell and 2 months to buy and it takes an exact year to flip.

So let's begin, we have $100k to go shop.

Website Purchase 1 - $100k

That $100,000 divided by 30x buys you a site cash-flowing (putting money in your pocket) to the tune of $3333 per month.

You pull your lever and within 3 months income has doubled from $3,333 to $6,666 and you list the asset after 6 months at this new level (to prove to buyers this isn't a fortunate spike).

The website asset value is now $200,000 and it sells after one month and you bank $170,000 (minus sales fees). However you also banked 3 months at the existing $3333 level and 6 months at the improved $6666 level (again for simplicity) for an additional $50k totalling $220k.

You started with $100k and now you have $220k for buying a new site making $7333/m.

Website Purchase 2 - $220k

You buy a site making $7333/m and, after 3 months, double monthly income to $14,666/m and then 6 months later list the site for $440k.

You sell and bank $374k plus $110k in earnings for $484k.

Website Purchase 3 - $484k

That buys a new site that's spitting out $16,133/m and you pull your lever one more time and get income to $32,266/m for a sale price of $968k.

You sell and bank $822,800. Add in the 9 months income totalling $242k and congrats - in 36 months you have now taken that $100k to over $1MM.

Conclusion

Yes this is overly simplistic and it assumes that people are able to double a site every time and that nothing devastating happens like a google medic update on a health site that will cost you.

However to counter this, multiples are going up over time and larger sites actually achieve a higher multiple. Yes this hurts your 40% return, perhaps you will only be able to achieve 30% yields on purchase however this does mean that your $32,266/m asset is now, at a 40x multiple, worth $1.3MM netting you over a million after broker commission.

And if you're thinking, well what about the money you need to invest in

Anyone can learn to build a six figure content site to get to $100k and if you've got the stomach to go all in, you are in theory just 3 flips away from achieving 7 figures.

But then you may realize that a $1MM sale price will not be enough for you to retire and rather than flip you may simply cashflow the web property instead to the tune of $30k/m.

Learn more about the world of website investing in my publication and sign up to receive the free Website Investing Weekly email.