🤑 Investing Updates (12th Jan)

This Thursday's top stories for online entrepreneurs turned investors, with updates on the markets, online business, real estate, startups, and crypto.

Hi there 👋,

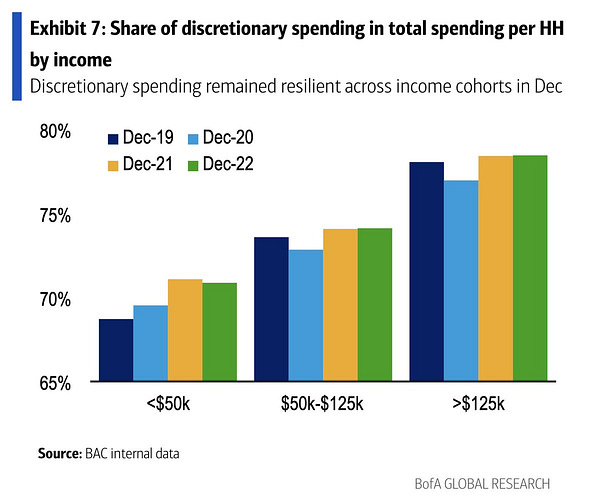

The CPI dropped by 0.1% in December, marking the 6th consecutive month of lower inflation, but the annual inflation rate for the US remains at 6.5%. This is over 3x the Fed’s 2% inflation goal, and discretionary spending remains high…

MARKETS UPDATE

Negative private equity returns are a major threat to public pension plans to compensate all their retirees. A reporting lag in PE return data means that public pension plans will capture the 2022 losses in their 2023 numbers. This is on top of acute losses in public equities last year, and could push the national average funded ratio to below 2008 levels.

Goldman Sachs is no longer expecting a technical recession in the eurozone, it expects the economy to grow by 0.6% this year.

Jamie Dimon says that the American consumer is still strong stating “their balance sheets are in good shape”.

ONLINE BUSINESS UPDATE

Michael Bereslavsky, the CEO of Domain Magnate, is taking a step back and bringing on Marc Roca as a new managing partner to head the day-to-day operations at the PE side of the business. Marc has extensive experience in both content and e-commerce with over 25 acquisitions in the last 5 years, and was the founder of the third amazon aggregator. Domain Magnate is currently buying a $1.6M website in the arts and crafts niche and has a $250K allocation left which it aims to close by the end of today.

Centurica, who offer premium due diligence services, are looking to make some acquisitions of their own. Nate Ginsburg, the CEO, states they are looking at ecommerce, digital agencies, SaaS and content sites in the $500K - $5M deal value range and that they can “be a bit messy as we have strong ops team that can come in to clean them up.”

Jamie the founder of increasing.com put out a December 2022 Niche Site Income Report where he broke down how his portfolio of sites made over $80K last month, despite being hit by a google update.

Onfolio (ONFO), mentioned in Travis’ personal newsletter A real-world example of buying $1 for $.50 is up over 24% YTD and up almost 100% from its lows, post IPO.

Sponsored Ad

🔥 HOT ON FLIPPA 🔥

Looking for a brand-new business opportunity for 2023? These are Flippa’s hottest assets right now, chosen by their expert team.

1. Top $100K+ Deal - See here

10-year-old calisthenics fitness website with 92% organic traffic and high-performing affiliate marketing.

2. Top $500K+ Deal - See here

2-year-old Ecommerce business, leader in the medical smartwatch industry with a 38% profit margin, making $26K p/mo.

3. Top $1M+ Deal - See here

12-year-old, top-rated heart rate app generating $145K p/mo, with a strong 82% profit margin and 225K MAU.

Get daily deals delivered straight to your inbox:

STARTUPS UPDATE

Carta, the equity management platform, that was last valued at $7.4B, has cut 10% of its staff and is suing its former CTO.

Microsoft is in talks to invest up to $10B at a ~$29B valuation in the ChatGPT creator OpenAI. This is after reporting stating that Bing could integrate ChatGPT as early as March.

OpenAI is thinking about ways of monetizing ChatGPT, possibly via a professional/premium version.

Flexport, a supply chain software startup, is cutting 20% of its staff (~640 employees), with the CEO citing the global macroeconomic downturn and softening trade volumes. Flexport was valued at $8B last year.

CRYPTO UPDATE

FTX says it has located more than $5B in cash and other liquid assets and is hoping to sell additional holdings with a book value of more than $4.6B.

Easy has raised $14.2M to build a user-friendly crypto wallet, to help onboard more mainstream audiences.

Coinbase is to cut 20% of its workforce as crypto or ~950 people, on top of the 1,100 laid off employees last year. The CEO is citing fallout from bad actors in the industry.

There’s a rumor that Twitter is working to implement its own internal token:

REAL ESTATE UPDATE

The Fed is ‘collapsing’ real estate activity with higher interest rates. Home sales have declined over the last year from 6M to 4.1M.

A survey of real estate finance executives finds rising interest rates are the top concern for raising capital in 2023.

UK-based proptech startup Fractal Homes raises a $30M seed round to enables more wealthy individuals to own second homes in desirable European cities, through a co-ownership model.

Interested in sponsoring our newsletter?

You'll find all the details here.

That’s it for this week. If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.doc