🤑 Investing Updates (Jan 26)

This Thursday's top stories for online entrepreneurs turned investors, with updates on the markets, online business, real estate, startups, and crypto.

MARKETS UPDATE

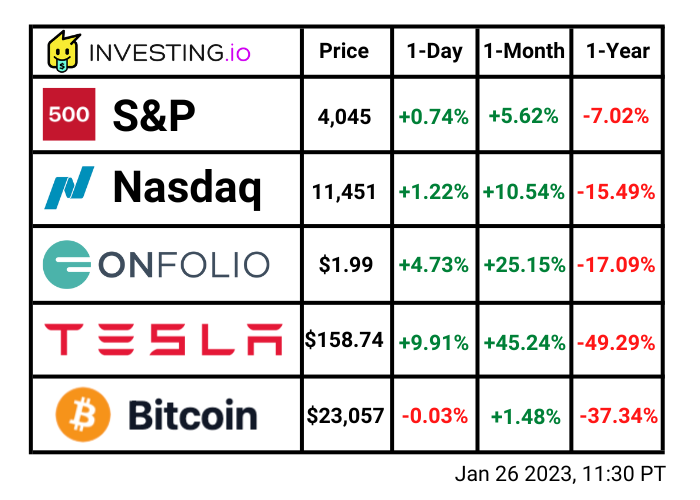

U.S. GDP rose 2.9% in the three months from October to December 2022, but the 2022 growth rate cooled compared to Q3, due to interest rate hikes, decreased consumer spending, and weak economies overseas.

Blackstone, the world's largest manager of alternative assets, reported a 41% YoY decline in its Q4 earnings, as asset sales declined by 55%.

Tesla beat Q4 analyst estimates with their best-ever quarterly revenue, and it’s share price is up 10% today.

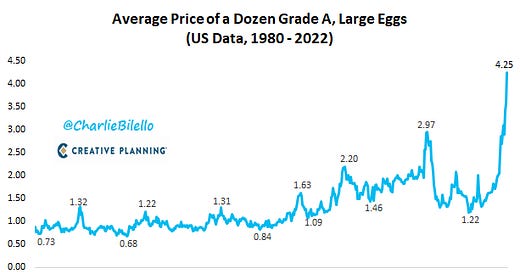

Chart of the day

ONLINE BUSINESS UPDATE

EF Capital, which just closed its latest investment round with over $3.8M raised, is rebranding to WebStreet. They state that long term this will lead to better investor returns through increased deal flow, with their vision being to deploy $100M per year.

The market-leading affiliate site Dog Food Advisor was acquired for $9M earlier this month by Wag!, expanding its reach into the pet food and treats market of the pet industry.

CNET’s AI-written financial articles have drawn criticism for significant factual errors. It’s been forced to add a new disclaimer stating "We are actively reviewing all our AI-assisted pieces".

Sponsored Ad

HOW MUCH IS YOUR BUSINESS WORTH? 🤑

You could Google ‘get your business valued’, click on random websites and hope for the best. Or you can go on Flippa.com and test out the world’s most accurate valuation tool.

Backed by the most extensive bank of data, Flippa’s valuation tool cross-references all the information you supply with 10+ years of transaction data.

It crunches over 40 metrics per valuation: business model, age, domain authority, growth rate, competition, niche…

The result is the best possible indication of what your business is worth in less than three minutes. Now that’s something.

Put it to the test now, click below!

STARTUPS UPDATE

Asset Reality, a London startup that helps its clients track and recover stolen digital assets, raises a $4.9 million seed round led by Framework Ventures, along with TechStars.

Digital-first health insurance provider Angle Health raises a $58M Series A funding led by Portage.

EV charging management platform Ampeco raised a $13M Series A led by BMW iVentures. Its platform lets customers pick and choose from hardware partners.

CRYPTO UPDATE

Tesla HODLd all its Bitcoin during the crypto market turmoil in Q4.

Grayscale Investments is taking SEC to court over its decision to reject their spot bitcoin ETF proposal.

BlockFi’s mistakenly uploaded financials show a $1.2 billion relationship with FTX and Alameda Research.

REAL ESTATE UPDATE

Existing home sales dropped 1.5% in December, and are 34% lower than 12 months prior, with low supply supporting prices.

RE/MAX announced the release of its MAX/Tech platform in the U.S. after a successful launch in Canada late last year. Features include customizable websites, lead engine, and an AI-powered CRM.

Metahood, a platform for trading real estate in the metaverse, launches in public beta and announces its $3M seed round, enabling trading of assets within popular metaverses such as Otherside, Sandbox, and Decenterland.

Interested in sponsoring our newsletter?

You'll find all the details here.

That’s it for this week. If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.doc