🤑 Investing Updates (Mar 2)

This Thursday's top stories for online entrepreneurs turned investors, with updates on the markets, online business, real estate, startups, and crypto.

MARKETS UPDATE

Entire US treasury market now yields at least 4%.

Home foreclosures are ticking back up.

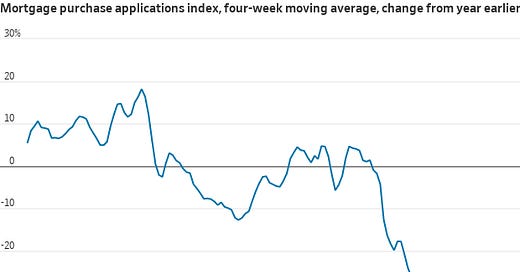

Mortgage demand from homebuyers drops to a 28-year low…

Chart of the day

ONLINE BUSINESS UPDATE

Nate at Centurica dropped another graph showing the total market listing value. Q3 of 2021 stands out as a watershed moment, where strong new listing value was matched by a strong sold percentage, propelling the market to its highest quarterly valuation. However, Q4 of 2022 however saw the lowest market value since Q1 of 2020:

Following on from last week’s update on Nick Eubanks joining Semrush as Head of Digital Asset Acquisition, investing.io community member Matthew Howells-Barby announced that Semrush had just acquired his Traffic Think Tank SEO training & private community:

- tracked 38 new content site marketplace listings this week.

Sponsored Ad

Market slowdown? These five businesses just sold for 4x or more…

Some are reporting a slowdown. Others are not. As the #1 marketplace to buy & sell online businesses, Flippa has been trying to make sense of it.

Overall marketplace value for the 6-month period Sep to Feb 23, against the prior 6-month period, is up 19% with February peaking to $153MM. Similarly, the number of units listed (priced between $10k and $5MM) is also up 19% when compared to the prior 6-month period. Owners are active and selling.

Buyer demand looks steady too and deals are getting done. Acquisition entrepreneurs are now being joined by a larger volume of Family Offices and PE firms looking to capitalize. These five deals recently achieved 4x+ multiples:

A marketplace for influencers achieved a 22x net profit multiple to sell for AUD $4MM.

A marketing agency achieved a 5x net profit multiple to sell for USD $2.7MM

An options trading subscription business sold for 4x net profit to sell for USD1.6MM

A college mentorship and consulting platform sold for 4x net profit for USD $385K

A marketplace for tours and tickets sold for 5.2x net profit for USD $441K

Have a business you want to buy or sell?

Flippa has a new origination service…

STARTUPS UPDATE

Cloud storage platform Impossible Cloud raised a $7.5M seed round led by HV Capital.

Zarta, a creator platform focused on pay-per-view video content, raised a $5.7M seed round led by a16z.

Generative AI startup Typeface emerged from stealth mode with an oversubscribed $65M funding round.

CRYPTO UPDATE

The liquid staking protocol ether.fi, raised $5.3M in funding led by North Island Ventures.

Fan token project Chiliz announced a $50M incubator and accelerator program for early-stage blockchain projects.

Investors have pulled ~$6B out of Binance's stablecoin following regulatory crackdown.

REAL ESTATE UPDATE

Property management software platform Renter Insight exits beta.

Nuveen Real Estate invested in a vertically integrated self-storage platform, MyPlace.

MSCI Real Assets reported that apartment sales volume plunged 71% YoY in January to $6.2B.

🤑 Other Investing Newsletters

#1 The Curiosity Chronicle

Join 250,000+ others who receive actionable ideas to help you build a high-performing, healthy, wealthy life.

#2 The Bootstrapped Founder

Proven tactics to help you launch, build, and grow your business based on the experiences of Arvid Kahl, author of Zero to Sold and founder of FeedbackPanda.

#3 The Income Stream from Tim Stodz

Tim Stoddart. the owner of Sober Nation, and partner in Copyblogger sends the week’s 10 best resources to help you generate more income.

Interested in sponsoring our newsletter?

You'll find all the details here.

That’s it for this week. If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.