The best alternative asset

Cash is king, online business deals, and re-writing existing content with AI

Together With:

Hi there, Richard here 👋

For those not familiar, I created the investing.substack.com publication that Travis acquired and we turned it into the investing.io community. I’m in your inbox today as a poor replacement for the awesome Juliet who normally writes this newsletter (don’t worry she’ll be back soon).

In this newsletter we have the top news along with our analysis of online business deals that are normally only for paying members of the community - just hit reply if you want to see more of these.

But first, here’s a brief update on investing from yours truly, following on from the epic I don't want to invest in a damn thing right now email that Travis sent 6 months ago.

Patey’s Perspective on Investing

It’s a crazy time here in the UK. Omicron infections are doubling every 2-3 days which means we could reach a million infections a day on this small island by the end of the year. France just closed their borders to us.

Have the markets already priced in what is about to happen, or are they so drunk on liquidity they can remain irrationally bullish? They’re certainly able to shrug off interest rate hike announcements with the FTSE 100 up today.

Two weeks ago, I sold the majority of my crypto holdings. When I mentioned this in my discord I actually had someone reach out to me to check that I was ok! But cutting out the noise and only looking at the moving averages on the weekly chart tells me it’s ok to be to sitting out on the sidelines.

Yes the long term (30 week - blue) average is still trending up but it didn’t start to fall at the end of the last bull market in 2018 until Bitcoin went from $20K to $7K. I’m happy to be wrong, but the risk to reward of staying majority invested through this is too much for me to stomach.

Regardless, I think the window of opportunity to make 100x from alts is over until the next bull market - below was $MATIC over the first half of this year.

If you’re still waiting for alt season I think you need to reevaluate.

And I sold my mutant ape NFT last week. I had a good offer for double what I paid and got freaked out when saw this tweet where someone’s ape had been sold on Opensea without their permission even though they were using a hardware wallet.

I wanted to wait until Coinbase NFT launched this month before selling my ape, as it will likely give the price a bump, but after going through the process of selling on OS using a HW wallet, I’m glad its value wasn’t any higher in USD as I had no idea what the transactions were I was signing and was certain was going to lose it.

And since then someone else has had their ape stolen…

Yes, this proves “we are still early” but that doesn’t mean that NFT floors in ETH are going to 10x over the next 6-12 months. I think it’s more likely it will go the other way (and fast) as liquidity starts to dry up from the three planned interest rate hikes coming next year in the US.

And I’ve realized that USD (or GBP in my case) is again the only thing that matters, rather than trying to stack more ETH (it was hard to rewire my brain on that one).

So what to invest in right now?

I think the best alternative asset right now is cash.

But what about inflation you say?

Even if it’s as high as 10%, I think it’s just as likely that almost every asset class - startup / website valuations, stocks, collectibles - will fall as much (if not more) at some point over the next year.

To invest in any alternative assets right now you have to be convinced that their current valuation is sound AND that their value will increase by more than inflation.

Otherwise, it’s just speculation and you’d be better off in cash too.

At investing.io we don’t gamble (ok we do play poker); instead, we look for opportunities within yield-generating assets or we sit out.

Cheers!

Richard Patey

Content Site Deal

Listing URL: https://empireflippers.com/listing/58053/

Price: $195,643 (47x L12M Profit)

Earnings: $4,163 L12M Profit

Niche: Home

Monetization: Amazon Affiliate (58%), Ezoic (42%)

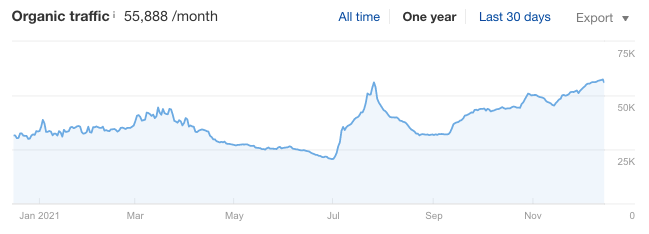

Ahrefs:

Our Thoughts:

With limited upside and no major immediate wins, this site isn’t ideal for a growth investor. Rather, it is perfect for someone who is relatively new to the space as he or she will not overwhelmed by a number of things to do. It’s a fairly straight forward site with a nice trajectory, ideal for those looking for a relatively passive investment.

Our Valuation:

36 * L12m Profit = $149,868

With limited upside, we wouldn’t pay too much in advance for this site. Initially offer 31x, citing fairly large traffic swings over the past ~13 or 14 months as a means of unreliability and no great growth opportunities.

What we like:

769 keywords ranking 11-20 with 200+ search volume, many with 1K+ searches

Traffic has grown fairly consistently throughout the year

Stable earnings

Potential to monetize affiliate offers with programs different from Amazon

Top page gets 7% traffic according to ahrefs

Good balance of info and money pages ranking

EAT better than most content sites

Switching from Ezoic to Mediavine may improve site revenue about 5%-10%/month

What we don’t like:

Quite specific - hard to expand out from primary topic

Our Verdict: ★★★★☆ Site has been growing but has limited upside. No major risks

Together With MicroAcquire

MicroAcquire 🤝 Clearco = Acquire Now, Pay Later

If you’re thinking of acquiring an eCommerce business, there’s no better time to do so.

MicroAcquire and Clearco have teamed up to offer a revenue-based financing option specifically for acquisitions relating to eCommerce businesses.

You can now apply for acquisition financing for any of the 350+ eCommerce startups currently listed on MicroAcquire. No debt or dilution is required, and no dead-end conversations with your local bank manager. Just a clear path to closing.

Join MicroAcquire for free to see all 350+ anonymous eCommerce listings. Become a Premium Buyer to start engaging before the New Year rush.

🍄 Read more about this acquisition financing option

Micro SaaS Deal

Listing URL: https://empireflippers.com/listing/57603/

Price: $184,958 (60 * L12M Profit)

Earnings: $5,567 L12M Revenue

Niche: Business

Monetization: SaaS/Subscription

Ahrefs:

Our Thoughts:

This is a solid SaaS business in a lucrative and highly sought-after offering that will always be in demand. While the space is quite competitive, the use of machine learning could be a key differentiator here and can help the offering outperform competitors.

There aren’t any quick wins that we saw, but we think there is great long-term potential. The ideal investor is someone with SaaS experience or existing B2B products that can integrate with this business or be offered as a package.

While there is revenue and profit information additional DD needs to be done to look at churn rates, CAC, etc.

Our Valuation:

54 * L12M Profit = $166,482

Go in at ~$140,000 citing additional resources required to hire a developer which will hurt the bottom line. Developers with cloud and machine learning experience are quite expensive to hire.

What we like:

X keywords ranking 11-20 with 200+ search volume, many with high buying intent

B2B instead of B2C which can translate to lower churn rates

Good page diversification - top 3 pages get just 25% of the site’s traffic

135+ active subscribers

Good ratings across the 2 platforms it is on

1100+ email subscribers

Evergreen niche

Great looking website and sales page that instills trust in the business

Content marketing opportunities to capture more traffic and potential customers

Real social media following despite not being very active

Good EAT

Opportunities for additional feature development

What we don’t like:

One founder is a developer so the new owner will likely have to pay for and outsource programming work

Competitive niche

Our Verdict: ★★★★★ Great business with seemingly good fundamentals (additional DD required here) on an upward trajectory.

AI Content At Scale - Sorry Humans

As an alternative to hiring freelance writers or paying content agencies 7c per word, let the GPT3 software with a service Content At Scale created by Justin McGill take the strain at a fraction of the cost. They see what others are doing in your industry, gather all the relevant keywords, and then their AI generates entire freshly written blog posts based on what is already proven to rank. Then, their team optimizes the content for SEO, creates relevant images and illustrations, and edits it all a final time to ensure quality. They can deliver over 200 long-form posts per month, check them out.

SEO Domain Deal

Domain: rivertheme.com

Buy now price: $1,000

Listing URL: https://app.juicemarket.com/domain/63fcc5e8-7241-4f4c-9772-93d58c9171b0

Wayback machine: Jan 2015

Our Thoughts: Strong DR52 domain that used to be a website that reviewed Wordpress Plugins and Themes, which can be a very lucrative niche. Over 400K backlinks according to Ahrefs. from Wordpress, Themeforest, Codecanyon etc. Above is how it looked in 2015, before being redirected to another site in 2017 and then dropped in 2019 and used for erotic manga! So obviously tread carefully with this one and make sure it ranks before thinking of redirecting to an existing site. But it’s priced fairly and is a decent two word .com name.

Never Ending Tickets

Creator Economy OGs Joe Pulizzi (who created and sold Content Marketing Institute) and Brian Clark (who created and sold Copyblogger) have teamed up for CEX - Creator Economy Expo, a limited event for 500+ content creators May 2-4, 2022 at the Arizona Grand Resort in Phoenix. The event will cover audience building, content operations, new revenue models and (of course) the move from Web2 to Web3. As part of the launch, CEX announced their NFT launch (or NET launch, CEX Never-Ending Tickets). The NETs mint at .75 ETH and include VIP and CEX attendance for life.

NFT Deal

Our deal for this week is any of our buy now listings ;)

Seriously though, if you’re not investing in NFTs for utility or access to a community (i.e. membership of a club) then just be aware that it’s all just one big glorious ponzi.

Interested in sponsoring our newsletter?

We’re booked out until March but would love to see if we could be a fit. Just email us at hey@investing.io

🙋 How did we do?

With your feedback, we can improve this newsletter. Please click on a link to vote:

You can also leave a voice message. Thanks!

There wasn’t a dedicated space for entrepreneurial investors like us… so we created one. Join over 200 members interested in digital asset & start-up discussions, plus deal-flow. All in our paid community. 🎉