🏁 The End of Jobs?

Are tech layoffs coupled with ChatGPT finally leading us to The End of Jobs? Plus updates on the markets, online business, real estate, startups, and crypto.

Happy New Year 👋,

As you’ll see in the markets update, 2023 appears to be the year for more tech layoffs, but the ratio of job openings to unemployed workers remains steady for now:

However, will the forthcoming recession coupled with OpenAI tools such as ChatGPT finally lead us to The End of Jobs?

MARKETS UPDATE

The Federal Reserve has agreed to slow the pace of its interest rate increases in order to control inflation while minimizing risks to economic growth, according to the minutes of the December policy meeting. Interest rate futures indicate that traders expect the Fed to lift the target rate to just below 5% in coming months and then begin cutting it in the second half of the year.

Amazon plans to cut 18,000 jobs, the largest number in the company's history, as it seeks to cut costs. CEO Andy Jassy cited the "uncertain economy" as the reason for the cuts, noting that the company had "hired rapidly over several years."

Salesforce is planning to cut approximately 10% of its workforce due to slowing demand and investor discontent with inflated spending. Salesforce's shares have dropped 55% from their late 2021 peak, resulting in a loss of $170bn in stock market value.

Vimeo is laying off 11% of its staff, as CEO Anjali Sud cites "a further deterioration in economic conditions" and a need to "simplify" the company.

ONLINE BUSINESS UPDATE

Microsoft is reportedly planning to launch a version of Bing that uses ChatGPT to answer search queries. The move is intended to make Bing more competitive with Google and provide more human-like responses to questions. Microsoft has a close relationship with OpenAI, having invested $1 billion in the company in 2019.

Matt Diggity put out a great video on how ChatGPT has changed SEO forever, answers the question is google here to stand, and lists ChatGPT SEO applications for doing keyword research, article optimization and link building.

AI newsletters on Substack (and other platforms) are booming - here’s a great AI newsletter listing 11 of the top AI newsletters right now.

Sponsored Ad

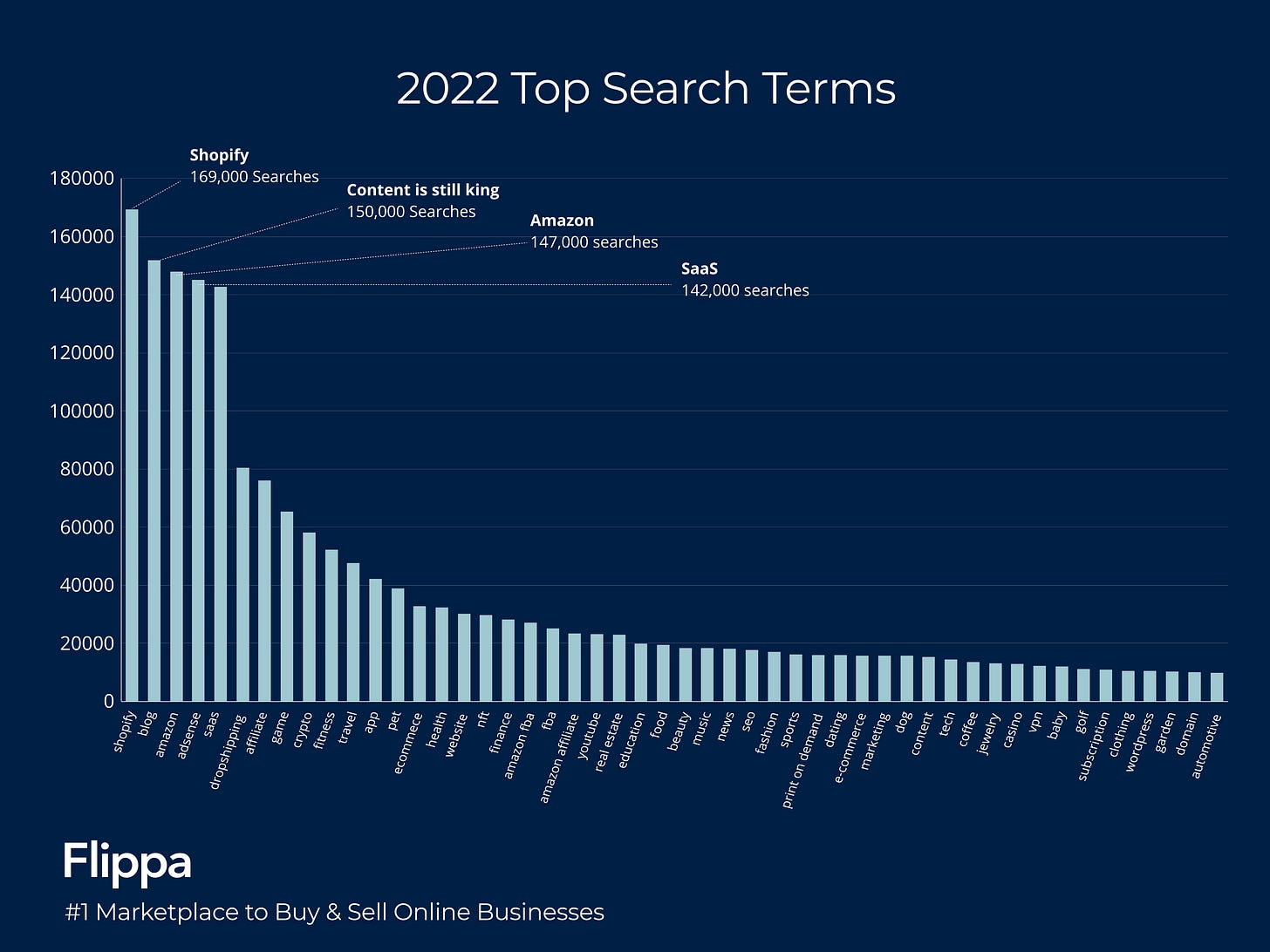

🔎 Flippa Insights: What 224,770 Buyers Searched For in 2022 🔍

Flippa has delved deep into its data to give you the most searched asset types and categories in 2022.

In Flippa’s new Insights Report, you will find out how Shopify-based ecommerce businesses were 2022’s most searched-for asset type with 19 searches per hour and a total of 169K queries.

But in total volume, content is still king, with 300K content asset-related searches (blog, adsense etc).

As a buyer, or a seller, learn what assets are in high demand by checking out Flippa’s 2022 Insights Report, which looks at buyer intent, acquisition multiples and more.

STARTUPS UPDATE

We used to publish a separate substack called Startup Grid. The last post, written by the awesome Juliet (who gave this epic goodbye before moving to running discourse at Onfolio), was 2 years ago.

The newsletter would pick cool tools such as this one where ChatGPT can now get you to inbox zero:

So we have a question/poll for you:

This would be a section inside this investing.substack.com rather than a separate substack publication (a feature they did not have at that time).

REAL ESTATE UPDATE

Home prices in Manhattan fell 5.5% to a median of $1.1m in Q4 2022 compared to the same period the previous year, according to Miller Samuel and Douglas Elliman. The decline was due to low inventory and high mortgage rates.

Blackstone's REIT receives a $4B investment from the University of California. The investment comes at a time when the $68B fund received requests to withdraw over 5% of the fund's net asset value in December.

China resumes approvals for private equity funds, in order to revive the country's real estate industry.

CRYPTO UPDATE

The popular Milkroad crypto newsletter founded by Shaan Puri from My First Million got acquired just 10 months after launch. It was built on the newsletter platform Beehiiv and grew to over 250,000 subscribers through organic and paid acquisition.

Genesis has said it will take additional time to resolve its financial issues and sort out its clients' locked-up funds, which are estimated to be around $900m. The company halted withdrawals in November and said in December that a resolution would likely take "weeks" rather than days.

Crypto asset funds saw a 95% drop in inflows in 2022, with a total of $433m compared to $9.1bn the previous year, according to CoinShares. The decline was largely due to the falling price of bitcoin, which fell around 60% over the same period, and a lack of investor confidence in the crypto market following the collapse of crypto exchange FTX and concerns over the liquidity of some key crypto platforms and lenders.

Solana based $BONK airdropped community tokens are up 28x over the last week.

Interested in sponsoring our newsletter?

You'll find all the details here.

If someone forwarded this letter to you, you can subscribe below:

Not financial, investing or tax advice. This newsletter is strictly for information, entertainment and education purposes. Nothing in here is investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your professional advisors. Do your own research.